India-EFTA TEPA: Impact of Free Trade Agreements (FTA) | Astrum

A Renewed Chapter in Economic Cooperation

A SILVER BULLET OR FOOL’S GOLD?

With the centennial of its independence just over two decades away, the nation has set its sights on an ambitious vision: Viksit Bharat, or Developed India, by 2047. The Viksit Bharat roadmap envisions a $30 trillion economy, propelling India to “Developed Nation” status, and centres on education, healthcare, technology, infrastructure, agriculture, and the environment.

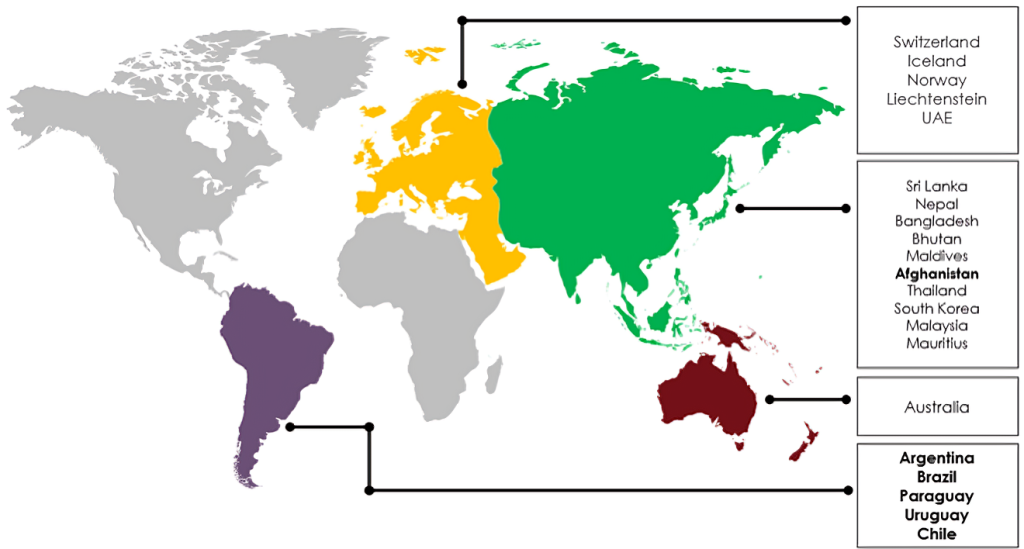

However, internal progress alone cannot help the country achieve its goals. Therefore, India must reposition itself globally as an attractive economic activity and trade destination. To achieve this, the Government has been strategically developing a series of Free Trade Agreements (FTAs) that they see as conduits, linking Indian industries to new markets, attracting foreign investments, and boosting exports. Currently, India has over 20 FTAs and Partial Trade Agreements (PTAs).

The rationale behind this approach is that by developing collaborative economic cross-country channels, Indian businesses can collaborate to enhance technology, research, and development, which are essential elements for transforming India into a knowledge-based powerhouse and improving competitiveness in the global arena.

However, does this tell us the whole story?

The debate with FTAs has always been one of ‘protectionism vs. liberalism‘ and continues today. There is a delicate balance between protecting an industry from imports and curbing competition altogether.

While FTAs are designed to increase bilateral trade, so far India’s experience has historically shown that imports often surge more than exports, creating a widening trade deficit, particularly with countries like ASEAN, Japan, and South Korea. This can put domestic industries at risk, as they face stiff competition from imported goods, potentially leading to job losses in sectors that are not yet globally competitive.

Furthermore, Indian FTAs have traditionally been criticised for their heavy emphasis on tariffs, with the primary goal of reducing or eliminating customs duties on traded goods. This approach increases market access for Indian exports and makes imported goods more affordable for consumers. However, this approach is not holistic and does not make significant real time impact in the trade landscape.

Globally, there has been a shift in how FTAs are formulated, focusing on shifting from border tariff elimination to encompassing a broader range of domestic policy areas. These include environment, labour, gender, digital trade, data governance, and more. This shift signifies a more comprehensive approach to modern FTAs, where the agreements are not solely about tariffs but also about setting standards and rules that govern various aspects of trade and economic cooperation.

India is strategically recalibrating its approach to FTAs, highlighted by the recently inked India-European Free Trade Association (EFTA) Trade and Economic Partnership Agreement (TEPA). While tariffs remain central, this agreement hints at a more comprehensive FTA framework. A thorough examination of the nuances of this new FTA follows.

INDIA-EFTA TEPA: A DEEP DIVE

| Date Signed | Countries Involved | Guaranteed Investment | Potential Benefits |

| March 10th, 2024 | Switzerland, Norway, Liechtenstein, Iceland | $100 Billion over 15 years | Improved relations, knowledge transfer, and a gateway to Europe |

Through an Indian Lens: Long-Term Plays

This FTA marks a significant step for India, strengthening ties with all four members. While its partnership with Switzerland is already robust, TEPA promises to solidify relationships with Iceland, Liechtenstein, and Norway, positioning India as a formidable trade partner.

Further, this agreement acts as a strategic springboard for India, offering immediate access to the lucrative EFTA markets. Some experts believe that it can also potentially create pathways to the European Union. The close economic ties between some EFTA members and the European Economic Area (EEA) create a bridge for India to explore future trade relations across Europe. EFTA also offers India more flexibility than the EU’s stricter regulations, easing the path towards smoother trade partnerships.

The agreement aligns perfectly with Prime Minister Modi’s vision for India’s economic growth through FTAs, unlocking significant benefits, including reduced tariffs. This makes Indian goods more competitive within EFTA. Beyond increased trade, India can gain valuable knowledge transfer and partnerships and attract crucial foreign investment in various sectors of the Indian economy.

However, while the deal offers India a chance at major investment, it comes with strings attached:

- Ambiguous Investment Commitment: EFTA’s $100 billion investment is more of an aspiration than a binding commitment, casting doubt on actual inflows to India.

- Uncertain Impact on Trade Volumes: While the deal aims to boost trade, current trade levels between India and EFTA are low. Further, excluding key sectors like agriculture might limit product diversification.

- Impact on Access to Affordable Medicines: Relaxing patent rules under the deal may jeopardise India’s generic drug industry and access to affordable medicines.

- Intellectual Property and Investment Protection: India’s IP stance, an IP-maximalist approach, is influenced by the U.S. and risks stifling innovation and tech self-reliance.

- Unwanted Competition: Increased global competition could strain unprepared Indian industries, impacting jobs, socio-economic growth, and the overall performance of the economy.

What Does This Mean for You?

Consumer Perspective

- Luxury Goods: TEPA slashes prices on luxury items like watches and jewellery, meeting India’s rising demand and expanding EFTA product options. It aims to triple gem and jewellery exports to $1 billion from $335 million. The agreement suggests duty-free EFTA imports and reduced customs tariffs on diamonds and precious metals.

- Processed Food: TEPA simplifies exports for Indian food brands by addressing safety standards and potentially reducing tariffs, making it easier for Indian companies to reach EFTA markets.

Business Perspective

- Pharmaceuticals: TEPA facilitates Indian pharma companies in drug development through tech transfer and standards recognition. However, India’s 2024 Patents (Amendment) Rules toughen patent challenges, reducing disclosure requirements. This risks evergreening existing drug patents and hiking generic medicine prices.

- Renewable Energy: Collaborative efforts focus on R&D, which could position India as a leader in clean energy innovation and a potential exporter of clean energy technologies.

- Technology: TEPA fosters R&D collaboration, providing Indian companies access to advanced technologies from EFTA countries, particularly in precision engineering and renewable energy.

- Skilled Professionals: The agreement streamlines the recognition of professional qualifications, easing the path for Indian professionals to work in EFTA countries. Thus, it addresses their skill shortages and provides Indians with job opportunities.

About the Authors:

Lakshmi Ravi

Counsellor at Astrum, Reputation Advisory, has five years of experience in strategic communications. She has worked on the USAID PAHAL project, NDTV, and various development agencies, excelling in impact documentation, filmmaking, social media marketing, content strategy, and public relations.

Gayathri Iyer

Senior Counsellor at Astrum, Reputation Advisory, brings nearly a decade of experience from leading think tanks and policy advocacy firms, focusing on research, dialogue creation, and policy narrative building. She has worked as an analyst with BowerGroupAsia and Observer Research Foundation.

Aditya Singla

Principal at Astrum, Reputation Advisory, Aditya started his career working in the Office of the Sh. Piyush Goyal, senior minister in the cabinet of Prime Minister Modi and has subsequently spent over half a decade with leading consulting firms, Environment Resource Management (ERM) and PwC as a part of the ESG Strategy consulting teams and has independently led C suite level client engagements. He holds a MSC in Environmental Science & Climate Change from the London School of Economics and Political Science (LSE) and a MA in Economics and Geography from the University of Aberdeen, Scotland.